Auto Insurance in and around Saint Paul

Saint Paul's first choice car insurance is right here

Insurance that lets you take the front seat

Would you like to create a personalized auto quote?

Be Ready For The Unexpected

Daily routines keep all of us on the go. We drive to baseball practice, school, book clubs and violin lessons. We go from one thing to the next and back again, almost automatically… until mishaps occur: things like fender benders, vandalism, hailstorms, and more.

Saint Paul's first choice car insurance is right here

Insurance that lets you take the front seat

Protect Your Ride

But there are lots of ways to get where you are going and move from Point A to Point B. State Farm also offers insurance for dune buggies, ATVs, van campers, canoes and trail bikes. Whatever you drive, State Farm has you covered and stands ready to help with great savings options and attentive service. Plus, your coverage can be aligned to your lifestyle, to include things like car rental insurance and rideshare insurance.

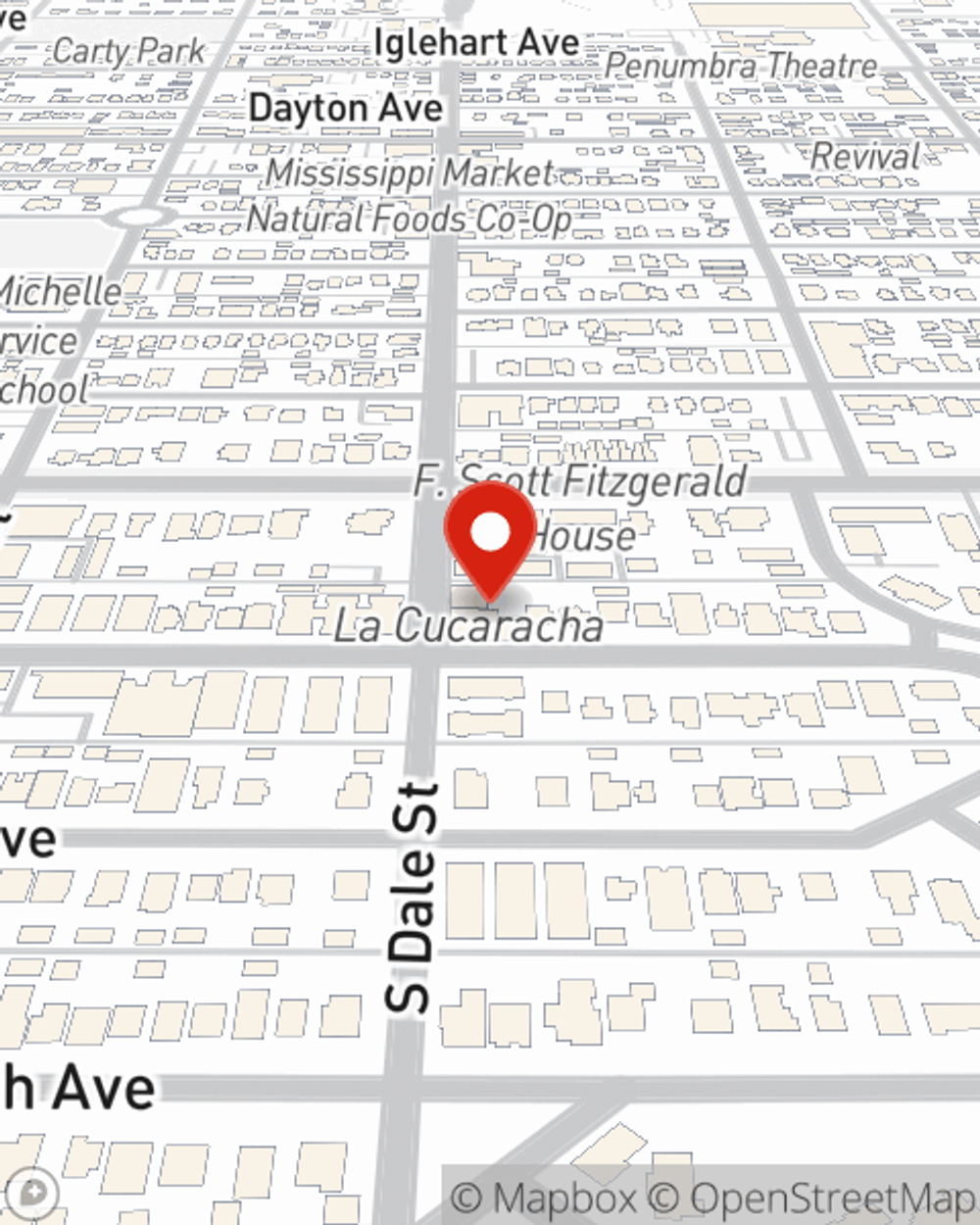

Want to explore the other options that may also be available to you? State Farm agent Kevin DeGezelle would love to walk through them with you and help you create a policy that fits your particular needs. Get in touch with Kevin DeGezelle to get started!

Have More Questions About Auto Insurance?

Call Kevin at (651) 222-4944 or visit our FAQ page.

Simple Insights®

How is car insurance calculated?

How is car insurance calculated?

Learn how car insurance is calculated, some common factors that affect car insurance rates and tips that may lower the premium.

What is full coverage auto insurance?

What is full coverage auto insurance?

Understand what full coverage auto insurance means. Learn about liability, collision and comprehensive coverage and find the right car insurance coverage for you.

Kevin DeGezelle

State Farm® Insurance AgentSimple Insights®

How is car insurance calculated?

How is car insurance calculated?

Learn how car insurance is calculated, some common factors that affect car insurance rates and tips that may lower the premium.

What is full coverage auto insurance?

What is full coverage auto insurance?

Understand what full coverage auto insurance means. Learn about liability, collision and comprehensive coverage and find the right car insurance coverage for you.